Introduction: Understanding IPOs

An Initial Public Offering (IPO) marks the moment when a private company offers its shares to the public for the first time, transforming into a publicly traded entity. This guide is tailored for beginners to grasp the essentials of IPOs, their process, and implications.

1. What is an IPO?

An IPO, or Initial Public Offering, is essentially the first sale of stock by a company to the public. It’s a significant step where a private company becomes public, allowing anyone to own a piece of it through stock purchases.

2. Why Companies Go Public

- Raising Capital: Companies often go public to raise funds for expansion, new projects, or debt repayment.

- Visibility and Prestige: Being listed on a stock exchange can enhance a company’s reputation, making it more attractive to talent, partners, and customers.

- Liquidity for Early Investors: Founders and early investors can convert their shares into cash, providing liquidity.

3. The IPO Process

- Planning: The decision to go public involves strategic planning, considering growth needs or market conditions.

- Hiring Underwriters: Companies engage investment banks as underwriters to manage the IPO process, from pricing to marketing.

- Drafting the Prospectus: A crucial document detailing the company’s business, financials, and risks, aimed at informing potential investors.

- SEC Filing: In the U.S., companies file an S-1 registration statement with the SEC, detailing the IPO.

- Roadshow: Management presents to investors in a series of meetings, known as roadshows, to generate interest.

- Pricing: The final price per share is set based on demand, market conditions, and company goals.

- Allocation and Listing: Shares are allocated, and trading begins on stock exchanges like the NYSE or Nasdaq.

4. Key Terms in IPOs

- Underwriting: The process where investment banks buy shares from the issuer and sell them to the public.

- Prospectus: A legal document providing details about the company and the offering.

- Greenshoe Option: Allows underwriters to sell additional shares if there’s high demand.

- Lock-Up Period: A time after the IPO when insiders can’t sell their shares, typically 90-180 days.

5. Benefits for Investors

- Opportunity for High Returns: Investing early in a company can lead to significant returns if the company performs well.

- Diversification: Adding new stocks can diversify an investment portfolio.

6. Risks Associated with IPOs

- Volatility: New stocks can be highly volatile, with prices fluctuating widely.

- Overvaluation: IPOs might be priced too high due to hype, leading to a drop in value post-listing.

- Lack of Historical Data: Less historical performance data for analysis compared to established public companies.

7. Real-World Examples

- Tech IPOs: Companies like Uber, Lyft, or SaaS giants have set benchmarks for tech IPOs.

- Analysis: Discussing how these IPOs performed post-listing can provide insights into market behavior.

8. Conclusion

Understanding IPOs is crucial for investors looking to diversify or seek high-growth opportunities. Always conduct thorough research or consult financial advisors before diving into IPO investments.

Why Companies Opt for FPO After an IPO: A Strategic Overview

1. Introduction In the world of public markets, Initial Public Offerings (IPOs) and Follow-on Public…

The Ultimate Guide to Understanding IPO vs. FPO: Differences, Benefits, and Risks

1. Introduction to the World of Public Offerings Capital markets thrive on the flow of…

How Book-Building IPOs Work: A Comprehensive Guide

Investor Perspectives on Book-Building IPOs Retail vs. Institutional Investors: In the book-building process, institutional investors…

Understanding Fixed Price IPOs: A Comprehensive Guide

Introduction: What is a Fixed Price IPO? A Fixed Price Initial Public Offering (IPO) is…

Mastering IPO Terminology: A Comprehensive Guide for Investors

Introduction Navigating the world of Initial Public Offerings (IPOs) can be daunting, especially with the…

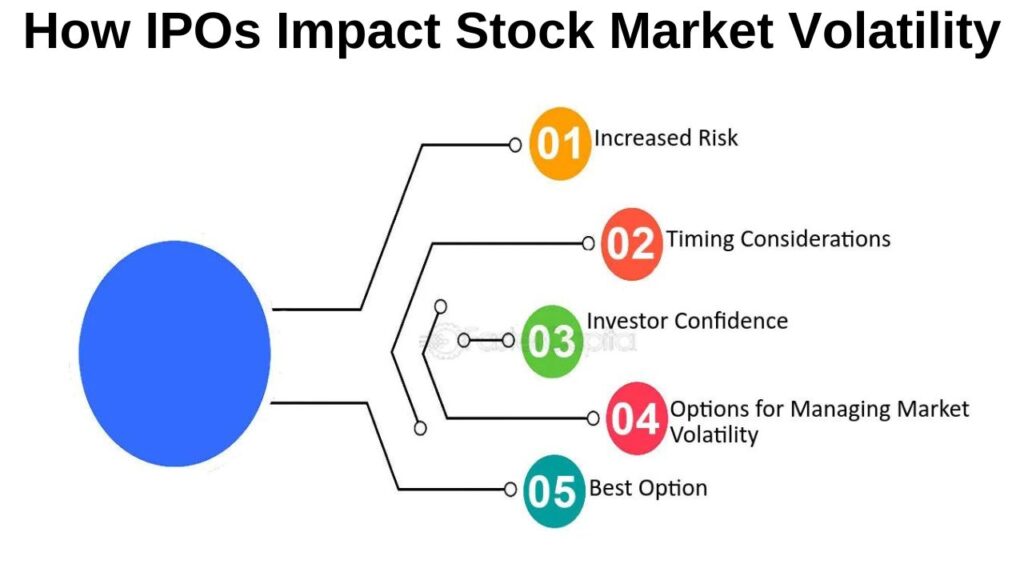

How IPOs Impact Stock Market Volatility

Introduction: The financial markets are a complex ecosystem, where Initial Public Offerings (IPOs) play a…