Introduction to Pelatro Limited IPO

Welcome to your ultimate guide on the Pelatro Limited IPO, an exciting opportunity in the tech investment landscape. Pelatro, known for its innovative Customer Engagement Platform, mViva, is stepping into the public market, presenting a unique chance for investors to engage with a company at the forefront of telecom analytics.

Check more details about Pelatro Limited here.

IPO Dates and Details

- Opening Date: September 16, 2024

- Closing Date: September 19, 2024

- Price Band: ₹190 to ₹200 per share

- Issue Size: Pelatro aims to raise approximately ₹55.98 crores through this IPO.

Here’s a comprehensive tabular representation of Pelatro Limited IPO details based on the information available up to September 16, 2024:

| Aspect | Details |

|---|---|

| IPO Open Date | September 16, 2024 |

| IPO Close Date | September 19, 2024 |

| Allotment Date | September 20, 2024 |

| Refund Initiation | September 23, 2024 |

| Credit of Shares | September 23, 2024 |

| Listing Date | September 24, 2024 |

| Price Band | ₹190 – ₹200 per share |

| Issue Size | ₹55.98 Crores (entirely fresh issue) |

| Lot Size | 600 Shares |

| Minimum Investment | ₹114,000 (based on the lower price band) |

| Book Running Lead Manager | Cumulative Capital Private Limited |

| Registrar | Bigshare Services Pvt Ltd |

| Retail Quota | 35% |

| QIB Quota | 50% |

| HNI Quota | 15% |

| GMP (Grey Market Premium) | ₹110 (as of recent updates) |

| Purpose of Issue | To meet working capital requirements, general corporate purposes, etc. |

| Company Founded | 2013 |

| Platform | mViva – Customer Engagement Platform |

| Market Deployment | Deployed across 38 telecom networks in 30 countries |

This table provides a detailed overview of the Pelatro Limited IPO, covering key dates, financial specifics, and company highlights for potential investors.

Purpose of the IPO

The purpose of Pelatro’s IPO extends beyond raising funds—it is about driving growth and expansion. The proceeds will be used for:

- Capital Expenditure: Investment in IT equipment, hardware, and server installations.

- Working Capital: Ensuring smooth operational efficiency and covering corporate expenses.

Financial Health and Performance

- Revenue Growth: Pelatro has shown steady revenue growth from FY22 to FY24, although it reported a loss in profit after tax during this period, which indicates a focus on long-term investment over short-term profitability.

- Asset Growth: The company has significantly increased its total assets, signaling a robust investment in expansion and infrastructure.

Here’s the financial information for Pelatro Limited in a tabular format for the fiscal year ending March 31, 2024:

| Financial Metric | 31 Mar 2024 |

|---|---|

| Assets (₹ Lakhs) | 5,780.92 |

| Revenue (₹ Lakhs) | 5,536.54 |

| Profit After Tax (₹ Lakhs) | -195.62 |

| Net Worth (₹ Lakhs) | 1,202.89 |

| Reserves and Surplus (₹ Lakhs) | 502.89 |

| Total Borrowing (₹ Lakhs) | 1,867.58 |

Key Financial Insights:

- Revenue: Pelatro Limited reported revenue of ₹5,536.54 lakhs, indicating the company’s operational scale.

- Profit After Tax (PAT): The company recorded a loss of ₹195.62 lakhs, suggesting operational challenges or investments that haven’t yet translated into profitability.

- Net Worth: Despite the loss, the net worth stands at ₹1,202.89 lakhs, which might include equity capital and accumulated losses or gains from previous years.

- Reserves and Surplus: At ₹502.89 lakhs, this represents retained earnings or surplus from previous periods, which could be utilized for future growth or offsetting losses.

- Total Borrowing: The company has significant borrowings of ₹1,867.58 lakhs, which could be for funding operations, expansion, or other corporate purposes.

This table provides a snapshot of Pelatro Limited’s financial health for the fiscal year ending March 31, 2024, highlighting areas of revenue generation, profitability challenges, and financial structure.

Market Sentiment and Analysis

Market Sentiment: Initial subscription data shows the IPO was subscribed at 0.43 times on the first day, with the retail portion hitting 0.79 times. This indicates moderate interest but not overwhelming demand.

Based on the information available up to September 18, 2024, here’s an overview of the Pelatro Limited IPO regarding its Grey Market Premium (GMP) and subscription status:

- Grey Market Premium (GMP): As of the latest updates, the GMP for Pelatro Limited’s IPO was reported to be around ₹0, indicating no premium over the issue price. This suggests that the market might not have strong expectations for a listing gain, or there could be a cautious approach due to various factors including the company’s financial performance or market conditions.

- Subscription Status:

- By the third day of its subscription period, Pelatro Limited’s IPO was subscribed 2.94 times, showcasing significant investor interest. This level of subscription indicates a positive reception from the market, though not as high as some other recent SME IPOs.

- Market Sentiment: From posts on X, there’s a mix of sentiments. Some users expressed skepticism about the business model due to competition in the customer engagement market, while others highlighted the company’s global technology enterprise status and innovative solutions, suggesting varied investor perceptions.

Analysis: Financials reveal revenue growth but a loss in the fiscal year ending March 2024. Despite this, the company’s deployment across 38 telecom networks globally suggests a robust market presence. However, investor sentiments on platforms like X (formerly Twitter) range from cautious optimism to outright avoidance, citing concerns over profitability and market conditions.

Investment Perspective: While some investors see potential for listing gains due to the tech sector’s allure, others advise caution due to the company’s current financial health. The consensus leans towards a cautious approach, suggesting potential for short-term gains but advising thorough due diligence for long-term investment.

Risks and Opportunities

- Risks: Pelatro faces challenges like market volatility, heavy reliance on key customers, and competition in the telecom analytics space.

- Opportunities: On the other hand, the growing telecom analytics sector, Pelatro’s global expansion plans, and advancements in customer engagement solutions present significant opportunities for growth.

Investment Perspective

Considering Pelatro’s current financials and growth strategy, this IPO may appeal more to investors with a long-term horizon. Those willing to hold for the future could see promising returns as Pelatro strengthens its position in the global market.

How to Invest in Pelatro IPO

- Application Process: Investors can apply for the IPO with a minimum investment of ₹1,14,000 for 600 shares. Various investment platforms are available for the application process, and investors should be aware of the lot size and other key details.

- Post-IPO Strategy: Investors may consider holding onto the shares for long-term gains, closely monitoring market trends and Pelatro’s post-listing performance.

Conclusion

The Pelatro Limited IPO offers a unique opportunity to invest in the growing tech and telecom analytics space. While the company is currently in a growth phase, focusing more on expansion than immediate profitability, it could provide substantial returns for patient investors willing to bet on its long-term potential.

Additional Insights

- Expert Opinions: Although not directly quoted, financial analysts have expressed cautious optimism about Pelatro’s IPO, particularly for long-term growth in the tech sector.

Pelatro Limited IPO reviewshould I invest in Pelatro Limited IPOPelatro Limited IPO allotment statusPelatro Limited IPO listing pricePelatro Limited IPO performance analysisPelatro Limited company profilePelatro Limited business modelPelatro Limited financial statementsPelatro Limited future prospectsPelatro Limited investment risks

Sahasra Electronics Solutions Limited’s IPO: Strong Market Reception with High GMP and Subscription Rates

September 27, 2024 – Sahasra Electronics Solutions Limited, an emerging player in the electronics manufacturing…

Phoenix Overseas Limited IPO Lists at Issue Price on NSE SME Platform

September 27, 2024 – Shares of Phoenix Overseas Limited, a B2B trading company specializing in…

BikeWo GreenTech Limited IPO Makes a Subdued Market Entry with a 27% Discount

September 27, 2024 – BikeWo GreenTech Limited, an electric two-wheeler retailer in India, made its…

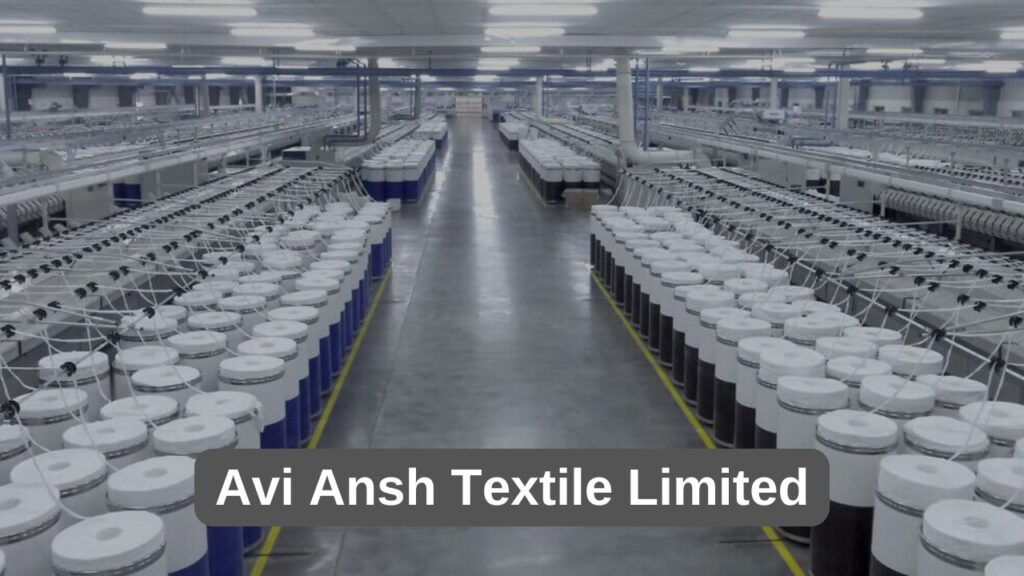

Avi Ansh Textile Limited IPO Soars on NSE SME Platform with a 9.68% Premium

New Delhi, September 27, 2024 – Avi Ansh Textile Limited, a name synonymous with quality…

SD Retail Limited IPO Soars with a 10.69% Premium on Listing Day

New Delhi, September 27, 2024 – The much-anticipated IPO of SD Retail Limited, a company…

Slicing into Success: The NeoPolitan Pizza and Foods Limited IPO

Introduction Welcome to a detailed slice of investment news—the NeoPolitan Pizza and Foods Limited IPO….

Pingback: Pelatro Limited: Revolutionizing Digital Customer Engagement - IPO Now