1. Introduction to Sodhani Academy of Fintech Enablers Limited IPO

Welcome to an in-depth exploration of the Sodhani Academy of Fintech Enablers Limited IPO, a significant event in the financial education sector. Established in 2009, Sodhani Academy has been a leader in promoting financial literacy, a crucial skill in today’s economy. This IPO marks a pivotal step in expanding its reach and enhancing its educational offerings.

2. IPO Basics

- IPO Dates: The Sodhani Academy of Fintech Enablers Limited IPO will open on September 12, 2024, and close on September 17, 2024.

- Price Band: The price has been fixed at ₹40 per share.

- Issue Size: The total issue size comprises 1,530,000 shares, amounting to ₹6.12 crores. This includes a fresh issue and an offer for sale (OFS).

- Purpose of Funds: The raised funds will be used for content development, infrastructure enhancement, technology upgrades, and marketing efforts.

Here’s a detailed tabular format for the Sodhani Academy of Fintech Enablers Limited IPO, based on the information provided:

| Aspect | Details |

|---|---|

| IPO Dates | Opens: September 12, 2024, Closes: September 17, 2024 |

| Issue Type | Fixed Price Issue |

| Price Band | ₹40 per share |

| Issue Size | ₹6.12 Crores |

| Fresh Issue | 9,70,000 shares (₹3.88 Crores) |

| Offer for Sale (OFS) | 5,60,000 shares (₹2.24 Crores) |

| Face Value | ₹10 per share |

| Lot Size | 3,000 shares (₹120,000) |

| Allotment Date | September 18, 2024 |

| Listing Date | September 23, 2024 |

| Registrar | Cameo Corporate Services Limited |

| Book Running Lead Manager | Srujan Alpha Capital Advisors Llp |

| Retail Allocation | 50% |

| GMP (Grey Market Premium) | ₹10 (as of last update) |

| Market Sentiment | Mixed, with cautious optimism due to niche market but concerns over scale |

| Purpose of Funds | Infrastructure, technology upgrades, marketing |

| Company Focus | Financial education, literacy, and awareness |

| Promoters | Mr. Rajesh Kumar Sodhani, Mrs. Priya Sodhani, Rajesh Kumar Sodhani HUF |

| IPO Application Methods | ASBA, UPI through various brokers |

| Listing Exchange | BSE SME |

This table encapsulates the key details of the Sodhani Academy of Fintech Enablers Limited IPO, providing potential investors with a comprehensive view of the offering.

3. Financial Performance and Market Position

Sodhani Academy has shown steady financial growth, with year-over-year increases in both revenue and profit after tax (PAT). This upward trend underscores the company’s solid market position in the financial education industry, driven by the growing demand for financial literacy.

4. Market Sentiment and Grey Market Premium (GMP)

The Grey Market Premium (GMP) for Sodhani Academy’s IPO was initially reported at +10, indicating a potential listing price of ₹50 per share, which is a 25% gain over the IPO price. Social media platforms like X (formerly Twitter) show a mix of cautious optimism and skepticism, with investors assessing the company’s small operation scale against the growing potential in the financial education sector.

5. Investment Considerations

- Lot Size: Investors must apply for a minimum of 3,000 shares, requiring an investment of ₹120,000.

- Risks: Key risks include the company’s small operational scale, reliance on other income for profits, and competition in the market.

- Opportunities: Opportunities lie in the niche market of financial education, the potential for scaling through technology, and the increasing demand for financial literacy, which could drive long-term growth.

6. How to Apply for the IPO

Investors can apply for the Sodhani Academy IPO through platforms like Angle One, 5 Paisa, Upstox, and IIFL, using methods such as ASBA or UPI. Below is a simple guide:

- ASBA Method: Apply directly through your net banking by linking your bank account to your demat account.

- UPI Method: Use your stock broker’s app to apply via UPI for a seamless experience.

7. Analyst and Community Reviews

Analysts, including Dilip Davda, have rated the IPO as a high risk/low return bet, citing concerns over the sustainability of margins. On forums like Chittorgarh, community sentiment has been cautious, with some users recommending an “avoid” stance due to the high reliance on other income streams for profitability.

8. Listing and Beyond

- Allotment Date: The allotment of shares is expected on September 18, 2024.

- Listing Date: The IPO is set to list on September 23, 2024, on the BSE SME platform.

The company’s performance post-listing will depend on its ability to effectively execute its growth strategy, with initial reactions in the market being mixed.

9. Conclusion

The Sodhani Academy of Fintech Enablers Limited IPO offers a unique opportunity for investors interested in the education and fintech sectors. While there are some risks involved, the growing demand for financial literacy positions this IPO as a potential growth story. However, it’s crucial for investors to consider their individual risk tolerance, investment goals, and market conditions before making a decision.

Sodhani Academy IPO Fintech Enablers IPO Sodhani Academy SME IPO IPO Analysis Sodhani Academy Sodhani Academy IPO Review Sodhani Academy IPO GMP Sodhani Academy Allotment Status IPO Price Band Sodhani Sodhani Academy Investment IPO Grey Market Premium

Sahasra Electronics Solutions Limited’s IPO: Strong Market Reception with High GMP and Subscription Rates

September 27, 2024 – Sahasra Electronics Solutions Limited, an emerging player in the electronics manufacturing…

Phoenix Overseas Limited IPO Lists at Issue Price on NSE SME Platform

September 27, 2024 – Shares of Phoenix Overseas Limited, a B2B trading company specializing in…

BikeWo GreenTech Limited IPO Makes a Subdued Market Entry with a 27% Discount

September 27, 2024 – BikeWo GreenTech Limited, an electric two-wheeler retailer in India, made its…

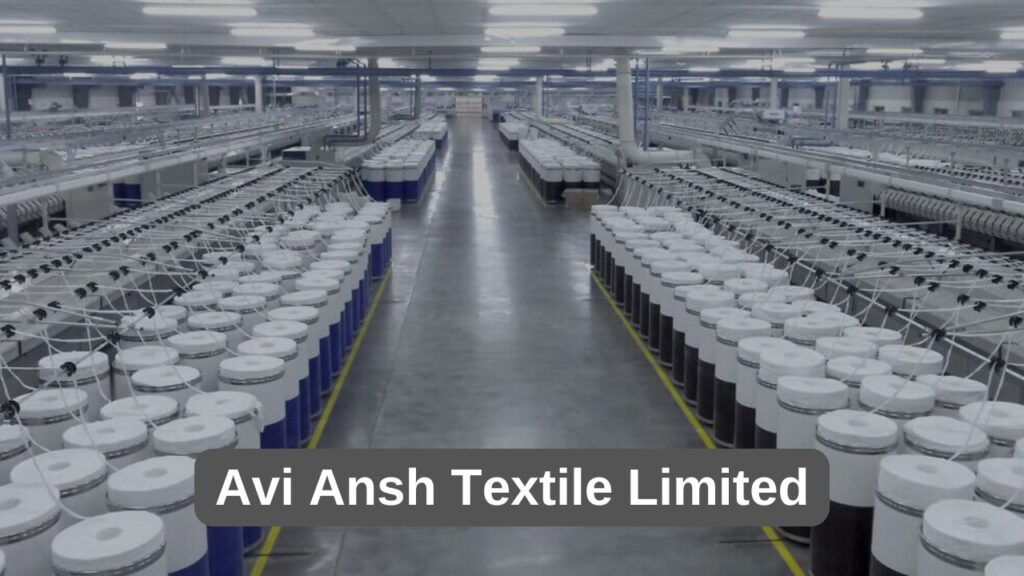

Avi Ansh Textile Limited IPO Soars on NSE SME Platform with a 9.68% Premium

New Delhi, September 27, 2024 – Avi Ansh Textile Limited, a name synonymous with quality…

SD Retail Limited IPO Soars with a 10.69% Premium on Listing Day

New Delhi, September 27, 2024 – The much-anticipated IPO of SD Retail Limited, a company…

Slicing into Success: The NeoPolitan Pizza and Foods Limited IPO

Introduction Welcome to a detailed slice of investment news—the NeoPolitan Pizza and Foods Limited IPO….