Introduction:

Investing in Initial Public Offerings (IPOs) can be likened to a high-stakes game where the potential for significant returns is matched by considerable risks. This blog aims to dissect both the allure and the pitfalls of IPO investments, providing insights for both novice and seasoned investors.

1. The Allure of High Potential Returns

- Why IPOs Attract Investors:

The promise of high returns if the company performs well post-IPO is a significant draw, often fueled by market hype and the allure of being an early investor.

2. Diversification and New Opportunities

- Broadening Your Portfolio:

Investing in IPOs can introduce new sectors or innovative companies into your investment portfolio, potentially reducing risk through diversification.

3. Access to Innovative Companies

- Investing in the Future:

IPOs often represent companies at the forefront of technology or market trends, offering a chance to invest in the next big thing.

4. Liquidity for Early Investors

- Understanding Liquidity Benefits:

While primarily benefiting company insiders, the liquidity provided by an IPO can reflect positively on stock valuation, offering a psychological boost to new investors.

5. Increased Company Visibility

- Brand Boost:

Going public can significantly enhance a company’s market presence, which might indirectly benefit investors through increased brand value.

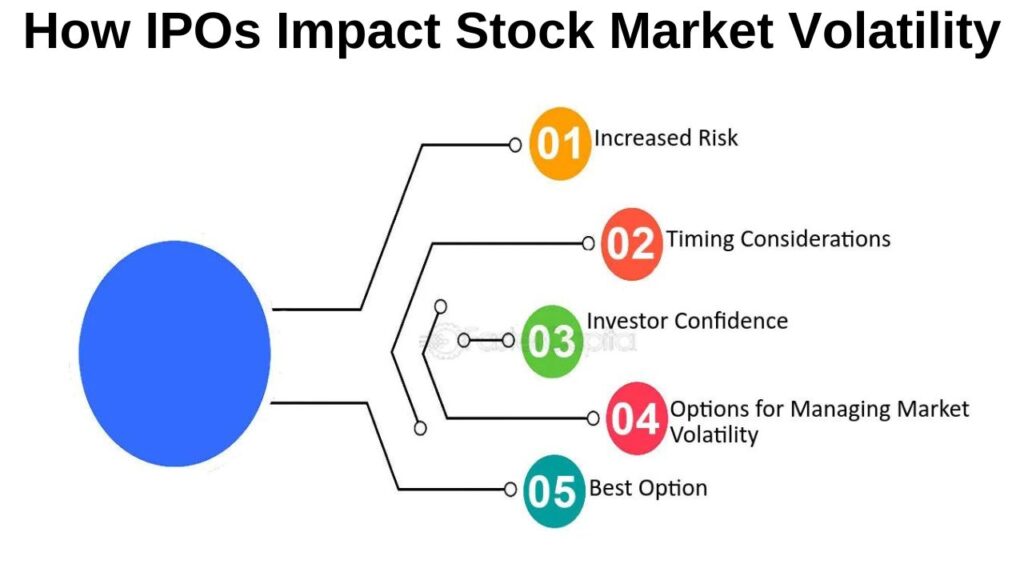

6. The Volatility Factor

- Navigating Price Swings:

New stocks are notorious for their volatility, often driven more by market sentiment than by the company’s underlying performance.

7. Overvaluation Risks

- The Price Bubble:

IPOs can be priced at unsustainable highs due to market hype, leading to a potential drop in stock price once the initial excitement wanes.

8. Lack of Historical Data

- Predicting Performance:

With limited historical data, predicting future performance can be challenging, making due diligence crucial.

9. Lock-Up Periods and Their Impact

- Post-Lock-Up Dynamics:

The end of lock-up periods can lead to significant stock price movements as insiders are allowed to sell their shares.

10. Market Timing and Conditions

- Timing Your Investment:

The success of an IPO can be heavily influenced by the broader market conditions at the time of listing.

11. Information Asymmetry

- Retail vs. Institutional Investors:

Retail investors might not have access to the same level of information as institutional investors, potentially leading to less informed investment decisions.

12. Regulatory and Compliance Risks

- Navigating New Public Life:

Companies new to public markets might struggle with regulatory compliance, which could impact operations and, consequently, stock performance.

How to Approach IPO Investing:

- Research and Due Diligence:

Thoroughly understand the company’s business model, industry position, and competitive landscape. - Financial Health Analysis:

Scrutinize financial statements, valuation metrics, and future earnings projections. - Market Timing:

Consider broader market trends and economic conditions at the time of IPO. - Post-IPO Monitoring:

Keep an eye on how the stock performs, especially post-lock-up.

Why Companies Opt for FPO After an IPO: A Strategic Overview

1. Introduction In the world of public markets, Initial Public Offerings (IPOs) and Follow-on Public…

The Ultimate Guide to Understanding IPO vs. FPO: Differences, Benefits, and Risks

1. Introduction to the World of Public Offerings Capital markets thrive on the flow of…

How Book-Building IPOs Work: A Comprehensive Guide

Investor Perspectives on Book-Building IPOs Retail vs. Institutional Investors: In the book-building process, institutional investors…

Understanding Fixed Price IPOs: A Comprehensive Guide

Introduction: What is a Fixed Price IPO? A Fixed Price Initial Public Offering (IPO) is…

Mastering IPO Terminology: A Comprehensive Guide for Investors

Introduction Navigating the world of Initial Public Offerings (IPOs) can be daunting, especially with the…

How IPOs Impact Stock Market Volatility

Introduction: The financial markets are a complex ecosystem, where Initial Public Offerings (IPOs) play a…